Here is a guide on how to proceed when you are going to do your reconciliation.

You must reconcile three types of receivables when you are going to do your year-end closing. This guide will explain you how.

Your receivables must be reconciled to ensure that they match the receivables that you have registered in your accounts.

Receivables from customers

When you reconcile receivables to customers, Shine has a standard function that helps you find any differences.

The procedure is the following :

- Create an extract of receivables (debtors) from Shine.

- Here you need to check whether you have received payments from your customers on any of the receivables registered on your debtor list.

To create the extract:

- Go to Accounting > Export data

- Export the Accounts receivable aging

Remember that the balance date for your export must be December 31 for the financial year you need to reconcile.

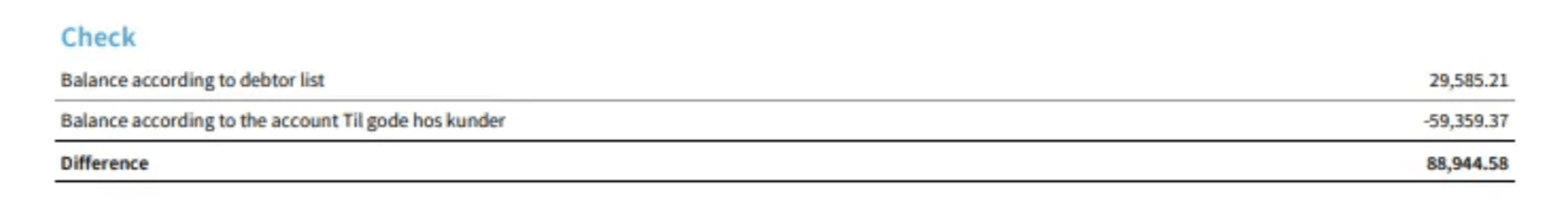

When you have reconciled your receivables, there should be no difference between your debtor list and the “Customer Receivables” account.

If you find a difference, as in the example here, it is often due to one of two things.

Case 1: You have received payment from a customer and forgot to register the payment on the invoice.

- In this case, you need to find the invoice and register it as paid.

Case 2: Alternatively, you have posted a payment from a customer manually as a financial document through the cash journal instead of registering the payment directly on the invoice.

- In this situation, you need to find and delete the financial entry and subsequently register the invoice as paid.

To find the transactions that are the cause of the difference, you can go to the account Credit to customers and search for Cash journal.

The transactions from the cash journal will then be displayed, and you can subsequently make the relevant changes in your accounting.

Other receivables

Finally, you should check whether you have other receivables in your accounts and whether these receivables have been recognized correctly. This will typically be the case if you use payment solutions in your company, such as Stripe or Paypal.

The receivables that you have with these companies should appear on your balance sheet on the assets side, typically under current assets. It is important to ensure that you have recorded all transfers from these companies correctly.

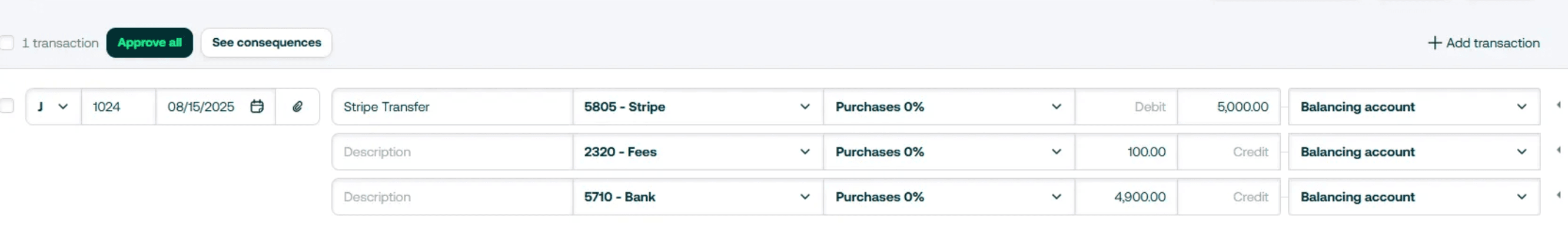

An example of how a payment from Stripe should be recorded can be seen here: