Start your business strong

Simple financial tools to help you kickstart your business with confidence and keep accounts in check from day one. We’ll handle the numbers, while you focus on the dream.

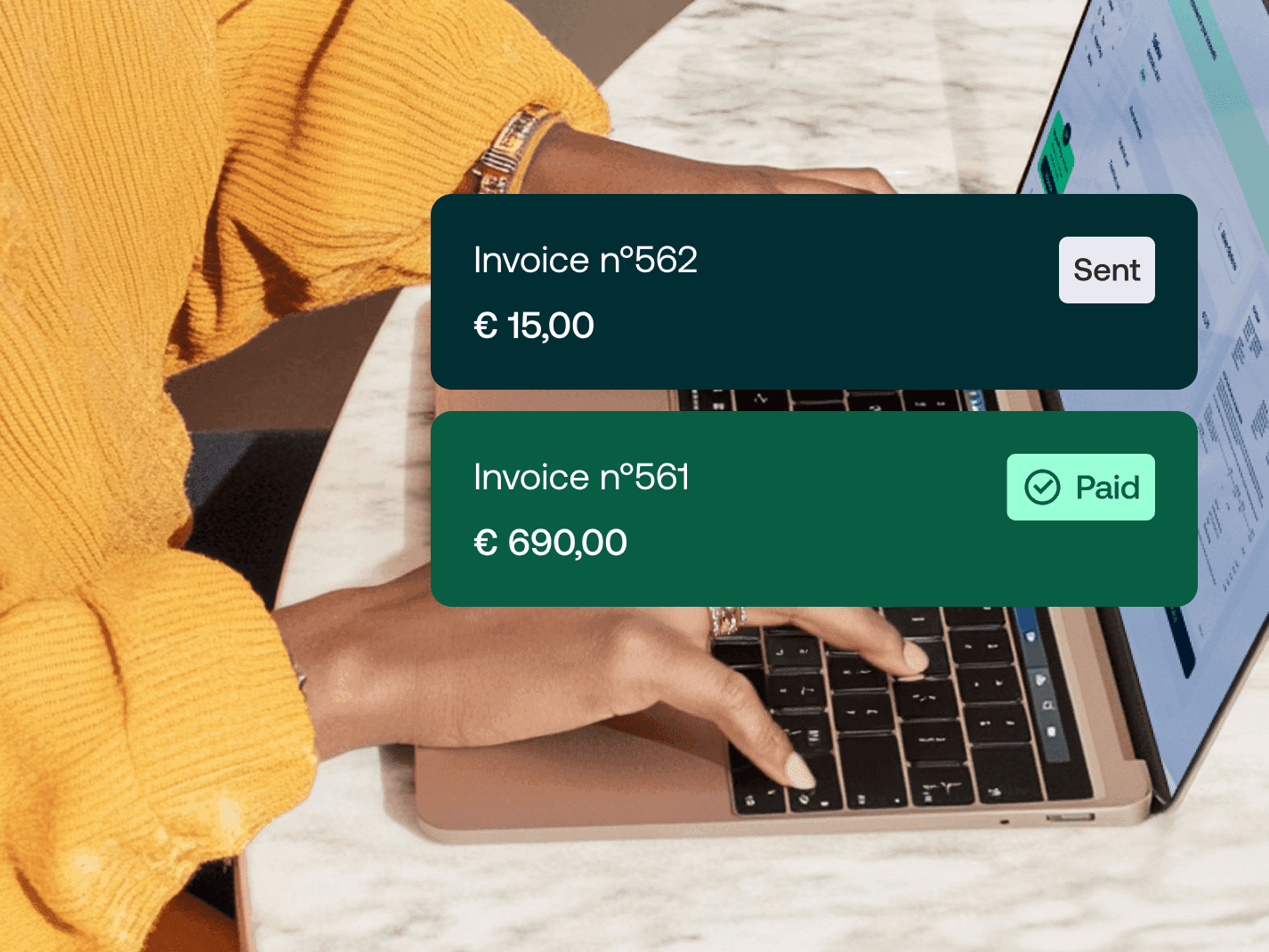

Send professional quotes and invoices in minutes

Track expenses and stay on top of your taxes

Get expert support whenever you need it

From first invoice to first tax filing and beyond, we're with you every step

Starting a business is exciting, but navigating the finances can be intimidating. We’ll get you started with invoicing and bookkeeping, so you can focus on building your business.

Set yourself up for success

Get your essentials up and running, inline with local regulations. Client-ready invoices and tax-ready books, without the hassle.

Polished and professional from day one

Create quote and invoice templates, for accurate numbers and consistent branding. Spend less time formatting and more time on the work that matters.

Send the right invoice. Every time.

Don’t let the admin hold you back from building your business - simplify your accounting tasks with intuitive tools and smart automations.

Invoicing without the hassle

Create professional invoices in minutes, reclaiming your spare time and helping you get paid faster.Integrate your bank accounts

Link Shine up with your bank to track business payments and keep your cash flow moving. Compatible with most Dutch banks.Smart expense tracking

Feel more organised with automated expense tracking. Scan receipts and categorise expenses directly in your mobile app.Join the 450,000+ businesses working with Shine

Choose your plan. And build your business your way.

Get your financial foundations right from day one - free invoicing, expense tracking, and receipt management with Shine.

Free

0

Start

9

Plus

20

Tips and bookkeeping advice for starting a business

We’re here to set you up for success with your new business. To get your started, here are the most common queries we get from business founders and entrepreneurs.

When starting a business in the Netherlands, choosing between a sole proprietorship (ZZP’er) and a private limited company (BV) is crucial. A ZZP’er is ideal for freelancers and small businesses with limited resources due to its low setup costs and simple registration process. However, it doesn’t offer liability protection—your personal assets are at risk if the business incurs debt. A BV, on the other hand, is a separate legal entity, shielding your personal assets but requiring more administrative work, higher setup costs, and compliance with stricter regulations.

Key factors to consider include liability risk, income level (BVs may be more tax-efficient above €100,000), and growth ambitions (BVs offer better options for scaling or attracting investors). ZZP’ers suit solo entrepreneurs who want a straightforward setup and minimal paperwork, while BVs are better for those seeking long-term growth and legal protection. It’s wise to consult a financial or legal expert to make the best choice for your situation.

As a business owner, you’ll need to pay VAT (BTW), income tax, and potentially corporation tax if you establish a BV. VAT is typically filed quarterly, while income tax is filed annually. Specific filing dates depend on your registration details with the Belastingdienst.

Staying organised and using accounting tools can simplify compliance with these obligations.

You can register your business with the Belastingdienst during your Chamber of Commerce (KvK) registration. The Belastingdienst will assign you a BTW number for VAT purposes. Depending on your business activities, you may need to charge VAT on your services or products, and file VAT returns quarterly.

Yes, self-employed individuals (ZZP’ers) can claim deductions such as the self-employed deduction (Zelfstandigenaftrek) and the small business scheme (Kleineondernemersregeling). These can significantly reduce your taxable income. Make sure to track your expenses carefully and consult with a tax professional to maximise your deductions while keeping your finances in check.

If you're starting a business in the Netherlands, keeping your bookkeeping in order is a must. The Dutch tax authority (Belastingdienst) requires you to keep clear, accurate records for at least seven years including all income and expenses, VAT (BTW) details, invoices, contracts, and bank statements. Make sure your invoices meet legal standards and file your VAT returns on time to avoid penalties.

The good news? You don’t have to do it all manually. Digital accounting tools like Shine can automate much of the work, helping you stay compliant, save time, and avoid costly mistakes. And if bookkeeping isn’t your thing, we can match you with a professional who’ll handle it for you—so you can focus on growing your business.