Here's a guide on how to correctly post your daily cash reports - also known as daily sales.

If you have some sales through e.g. payment services, you typically need to record the day's or month's sales. It can be a bit tricky to keep track of daily cash reports when you run a physical store. But with a little practice, it won't be a problem.

Book sales manually

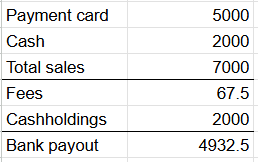

We will start with this simple version of a cash report, where all sales are subject to VAT.

The posting of the sale should be done in the cash drawer as follows:

- Go to the Accounting tab (on the left)

- Select Bookkeeping in the menu > Daybook > + Add transaction

- Enter the date of the day you are posting the sale from. This is typically the last day of the month for monthly reports or today's date for daily reports

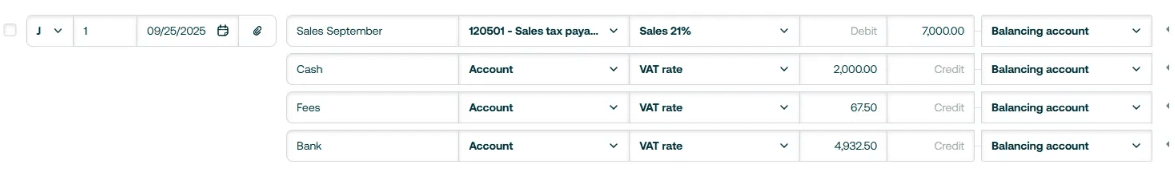

- We need to make a multi-legged entry, which means we need to add some lines to the cash drawer. You can do this by hovering over the small arrow to the far right of the cash register and clicking the little “+” that appears. Or you can press the command CTRL + L or COMMAND + L on a Macbook. We need 4 lines in total

- In the first line you can write the month or day sales on xx/xx-xx

- Select the revenue account

- Enter the total sales amount in Credit. Do not select a counter account

- Then go to the next line in the entry. Here you can, for example, indicate if there have been any cash sales. If you have, then enter Cash and select the account for your Cash balance. Remember to set the VAT to VAT Free (0%) or leave the field empty as you have registered the VAT through the first line

- Enter the amount of cash received in Debit

- On the next line, you can indicate if there has been a payment fee. If there was, you can enter Fee in the text field and select the account for Fees. Fees are VAT-free, so there is no need to enter anything for VAT

- Enter the fee amount in Debit

- On the last line, we need to enter the amount we have received in the bank from the payment program You can type “Payout” in the text field and select the account your Bank account

- Enter the amount in Debit. The amount should match the total sales minus fees and cash.

The entire transaction must add up so that there is no difference between the total sale and the amount paid out through bank and cash. You can see this at the bottom of the page when you are on the transaction.

Why are payment fees VAT-free?

Payment fees through payment providers or checkout systems are VAT-free as they are a fee. Fees are always VAT-free and should therefore be set as VAT-free when accounting for the day's or month's sales.

It varies greatly how much each payment provider charges to process and pay out your sales. Some only have transaction fees while others also have some monthly fees in addition to the subscription price.