In Shine’s cash journal, you have the option to import entries made in Excel. To do so, please follow this guide.

First of all, you gonna have to upload a CSV file, which must follow certain formats. A CSV file is a text file with comma-separated values, which is generally used for data transfer between databases. The CSV file must have some predetermined columns and values, which are described below.

Please note that the function only works if you make use of account numbers in your chart of accounts.

Import a cash journal CSV file

To import the CSV file to the cash journal, go to Accounting > Journal > More > Import.

If there are errors in your file, the programme will automatically tell you what the error is and possibly which row and column it is.

However, you should be aware that the file must fulfill a number of conditions for the import to work.

The format of the CSV file

Separators

The file must be a CSV file where the import supports the following separators:

- Comma (,)

- Semicolon (;)

- Tab.

Rows

The first row (row 1) should always be column headers. This row is ignored on import, as are empty rows. You can then add all the rows you need to import into the daybook.

Columns

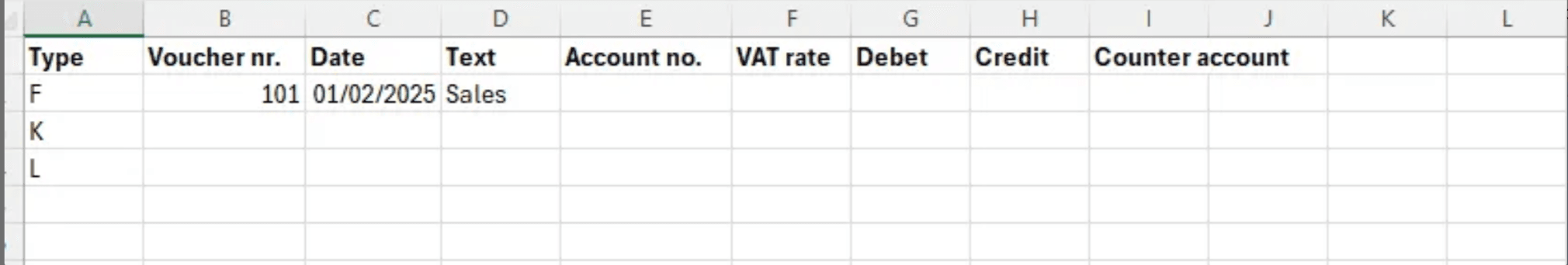

The columns from A to I in the Excel sheet must have the values below. You are not allowed to swap them around.

Column A: By Type you have the option to define whether the row indicates a :

- Financial voucher (F)

- Customer payment (K)

- Supplier payment (L)

The letters in brackets can be used as abbreviations. If the field is empty, the row will become a Financial voucher.

- Column B: Here you enter the desired voucher number for the transaction. If you put the same voucher number on multiple lines, it becomes one transaction. Make sure that the debit and credit are correct and that they, with the same number, are next to each other and not scattered around the Excel sheet.

- Column C: The date is entered in this row. If you have given several lines the same voucher number, you only need to enter the date for the first line.

- Column D: In this column, you can enter a description of the entry.

- Column E: Account number determines which account is posted to. If the row is a Customer payment, enter the invoice number instead. If the row is a Supplier payment, enter the invoice voucher number instead. If empty, the entry will be imported without an account.

- Column F: You can determine the VAT rate by using a valid abbreviation/tax code for one of your VAT rates. See a list of these inside the programme under Settings > VAT rates.

- Columns G - H: The amounts are set in either Debit or Credit. If a negative amount is entered in the debit column, it will automatically be credited, and the same goes for the credit column.

- Column I: The last column is the Counter account. You can use it if you have a simple entry with a counter account. Instead of using 2 lines, you can quickly select a counter account, just like in the Shine cash journal. If empty, the entry will be imported without a counter account.

Save the file as CSV and import : The transactions imported will be added to the end of the daybook. Any existing transactions will not be deleted.