Get ready for your success

Setting up and managing your finances shouldn’t slow you down when starting your business. With Shine, you get everything you need for a fast, confident start.

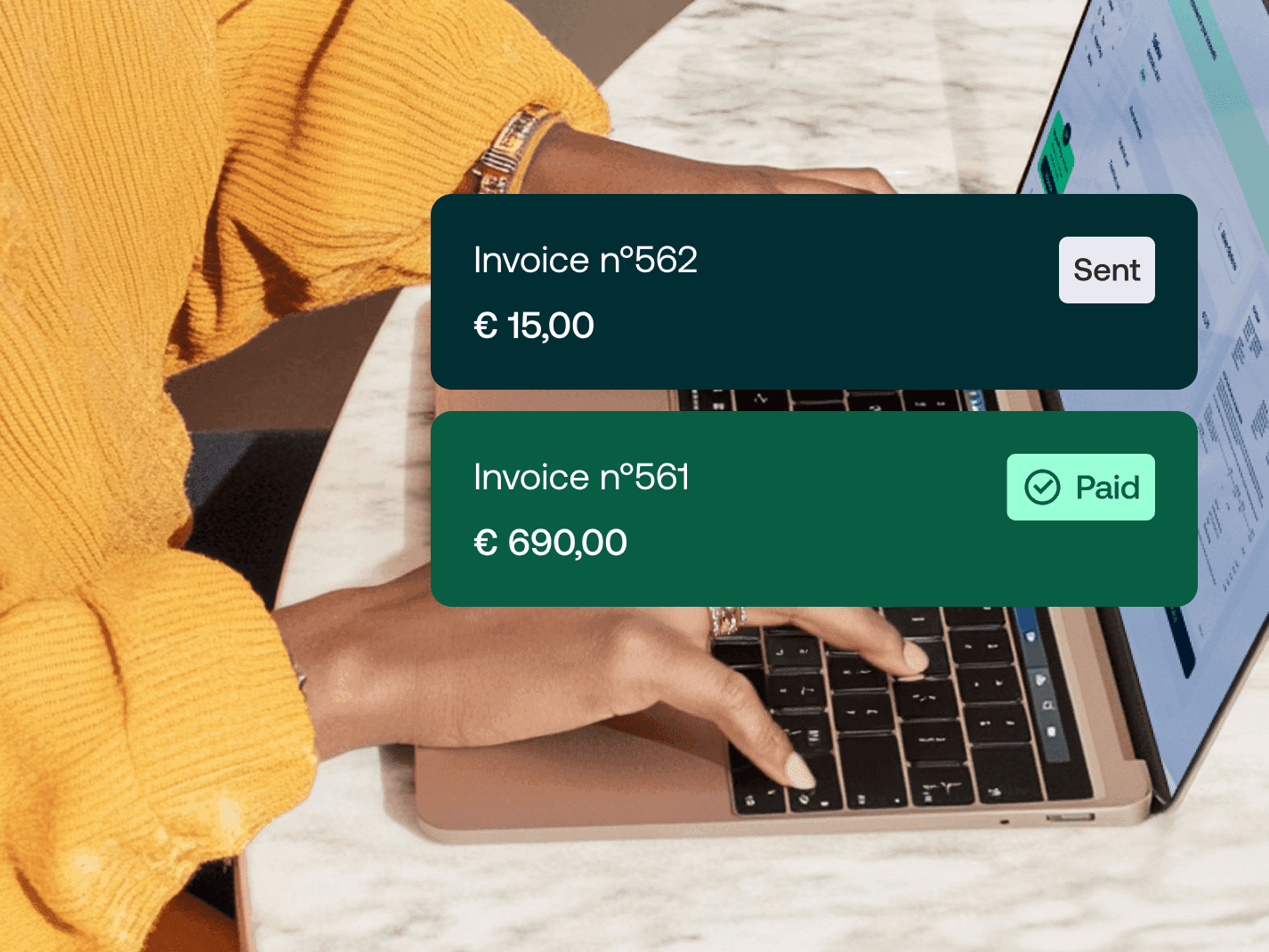

Effortless invoicing from day one

Invoicing is part of doing business – but it doesn’t have to be complicated. With Shine, you’re professional and compliant right from the start.

A professional look

Build trust from the very beginning with clear, well-structured estimates that reflect your brand.

FAQs

Questions about Shine for founders? Here you’ll find some answers. If your question isn’t covered, our customer support team will be happy to help.

You don’t have to provide any proof that you’re self-employed in order to use Shine. However, your invoices and quotes won’t be valid if you can’t provide the information that indicates that you are a registered freelancer later on. If you’re curious about how Shine works but you’re not registered with the tax office yet, you can still sign up and try it out.

Shine is designed to be used by solo-entrepreneurs and small businesses. That includes all of the standard legal forms in Germany, such as self-employed or Kleinunternehmer, GmbH, UG and GbR.

Yes. You can use the Free plan for as long as you like. If you want to test Start or Plus, you can do so for 60 days free of charge.

Shine is a powerful invoicing tool that can be used for free and upgraded as you go. That means that while you’re getting your business up and running, you won’t be weighed down by excessive overhead. Additionally, Shine helps you create a professional impression from day one and allows you to remain compliant thanks to features like invoicing templates.

Yes. Shine supports founders with invoicing, expense tracking, banking connections and compliant documentation – ideal for newly registered companies and small teams.